Alberta’s economy may not be firing on all cylinders yet but the signs are all pointing in the right direction for the engine to keep moving.

Alberta’s economy may not be firing on all cylinders yet but the signs are all pointing in the right direction for the engine to keep moving.

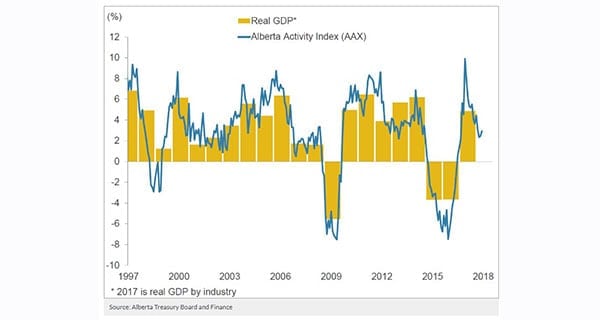

The Alberta Activity Index, produced by the provincial government, jumped 2.5 per cent in May, the fourth highest monthly growth rate on record and the government says the index is now 0.8 per cent above its pre-recession peak.

“Wholesale trade led the charge, recording the highest monthly growth rate in 24 years, spearheaded by a spike in agricultural supply sales,” it says. “Oil production, manufacturing shipments, housing starts, and new truck sales also saw notable gains.

“Year-over-year growth ticked up to 2.9 per cent from 2.5 per cent the month before.”

The index was developed by Alberta Treasury Board and Finance and is a weighted average of nine monthly indicators: employment, average weekly earnings, retail trade, wholesale trade, manufacturing shipments, new truck sales, housing starts, rigs drilling and oil production.

Meanwhile, RBC Economic Research says it expects Alberta’s recovery from its 2015-2016 recession to continue, albeit at a slower pace, over the next two years.

“The province has begun to attract net migrants from the rest of the country, oil production is growing, the manufacturing sector is bouncing back, and firms are hiring at a good clip again. However, a dearth in new oil sands investment and slack in the housing market shows the province’s economy has ground to recover,” says its provincial outlook.

“After growing at an estimated 4.7 per cent in 2017, we expect Alberta’s economy to expand by 2.4 per cent in both 2018 and 2019. Alberta endured a two-year-long recession in 2015 and 2016 caused by a dramatic pullback in oil and gas investment. Since that time, eyes have been on oil prices and investment intentions as a bellwether for Alberta’s full economic recovery and, so far, the news has been mixed. While oil production has continued to grow, investment spending in the oil and gas sector is expected to be broadly flat in 2018. There are tentative indications of a modest recovery beginning in 2019, but to a level far below the highs of 2013 and 2014.

“Future investment plans may be affected by concerns about pipeline and other transportation constraints. A number of multibillion-dollar projects are in the pipeline, including Keystone XL, which will alleviate those supply constraints over time, and will add to GDP as they are built. However, according to RBC Equity Research, it will be several years before new pipelines obviate the need for expensive rail transport to ship oil out of the province.”

Respected business writer Mario Toneguzzi is a veteran Calgary-based journalist who worked for 35 years for the Calgary Herald in various capacities, including 12 years as a senior business writer.

![]() The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

The views, opinions and positions expressed by columnists and contributors are the author’s alone. They do not inherently or expressly reflect the views, opinions and/or positions of our publication.

Calgary’s Business is a Troy Media Digital Solutions Associate website